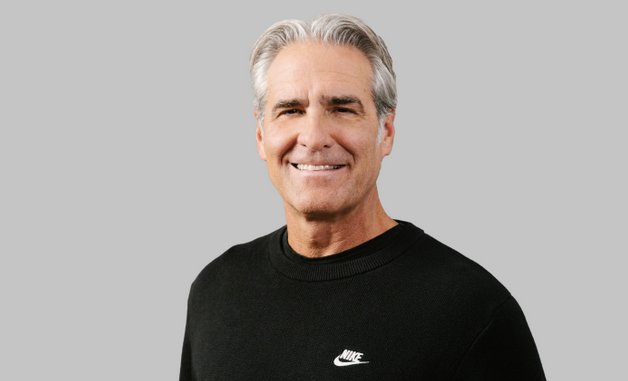

Elliott Hill Starts as Nike’s CEO Today: Here Are 4 Key Priorities He Needs to Address

It’s day one for Elliott Hill as Nike’s top dog.

Hill, who served in several leadership roles before retiring from the Swoosh in 2020, officially returned to Nike on Monday as its new chief executive officer. His appointment announcement last month was met with praise from employees and The Street, though analysts cautioned that it could take several quarters for him to fix the company’s longstanding issues in distribution, innovation and culture.

This month, Nike offered mixed results for the first quarter and withdrew its guidance for fiscal year 2025, suggesting a long road to recovery. As Hill takes the reins, here are four key areas where analysts and market watchers are looking for improvement.

Reigniting Wholesale

Nike’s decision to exit several wholesale doors in 2021 has kept the company behind competitors that have achieved controlled distribution in crucial channels like run specialty. Now, Hill must build on recent efforts to bolster wholesale sales and reengage key partners.

There’s already been some momentum. In the last year, Nike has re-entered or reinvigorated its wholesale partnerships with DSW, Macy’s and Foot Locker. And just last week, the Swoosh elevated Tom Peddie to the role of vice president, general manager of North America after rehiring him out of retirement in July to the role of vice president of marketplace partners to oversee wholesale partnerships. Prior to rejoining Nike, Peddle spent 30 years at the Swoosh culminating in his role as vice president and general manager of North America.

“Peddie’s extensive experience in global sales and emerging markets is expected to help rebalance Nike’s direct-to-consumer and wholesale strategies,” wrote Jefferies analyst Randal Konik in a Monday note to investors. “His role will involve overseeing all aspects of the North American market, aiming to drive strategic growth and improve relationships with retailers.”

Running Revamp

Nike has lost share in the running category for the last several quarters as competitors like Asics, Hoka, On and Brooks gain steam. Part of this lag has stemmed from a general lack of innovation in the category as well as a failure to strongly embed in the run specialty channel.

In its most recent earnings call, Nike leadership doubled down on renewed efforts to win in running. Chief financial officer Matthew Friend noted that the category’s order book for spring 2025 is set for double digit growth compared to the prior year. He also touted product enhancements like a new maximum cushioning system, new trail silhouettes and new franchises for under $100 a pair.

Still, analysts noted that a fix in Nike’s running business won’t happen overnight, and it could take several years for Hill to get this business back on track.

“It’ll take them more than two fiscal years to course correct,” Burt Flickinger, managing director and founder of retail consultancy Strategic Resource Group, told FN earlier this month. “And even then, competitors have such a big lead that Nike is so far down the proverbial track, it can’t even see how far ahead [they] are.”

Brand Heat

Nike’s brand equity has suffered from having too much of its key product in the marketplace.

A Sunday note from UBS analyst Jay Sole found that prices for Nike products on the secondary market are still in decline, which does not bode well for overall brand momentum. According to UBS data, the average last sale price for all Nike brand products was down 9 percent in September over the prior year. The average last sale price for Jordan brand products was down 12 percent.

To address this, Nike has recently set out to reduce the presence of its popular franchises — such as the Air Force 1, Air Jordan 1 and Dunk — to realign demand. At the same time, Nike will need to bolster its product innovation cycle to win mindshare from competitors.

The China Challenge

Revenue for Greater China was down 3 percent in Q1, which resulted in higher inventory levels in an “already promotional environment,” Friend said in a call with analysts. As a result, Nike lowered its short term expectations for sales in the region.

Despite the dip, Friend said Nike is “optimistic” about its long term potential in China as the company sharpens its ability to deliver products and experiences to local consumers.

“We’re going to keep playing our strengths around innovation and newness,” Friend said in an earnings call earlier this month. “We think that the investments that we have in the marketplace from a retail point of view and the way that we present our products to consumers through our partner stores gives us an opportunity to present our brand in a way that we can’t do anywhere else in the world.”